The submission date for this settlement program has passed.

The deadline was February 4 2025.

Thank you for your interest!

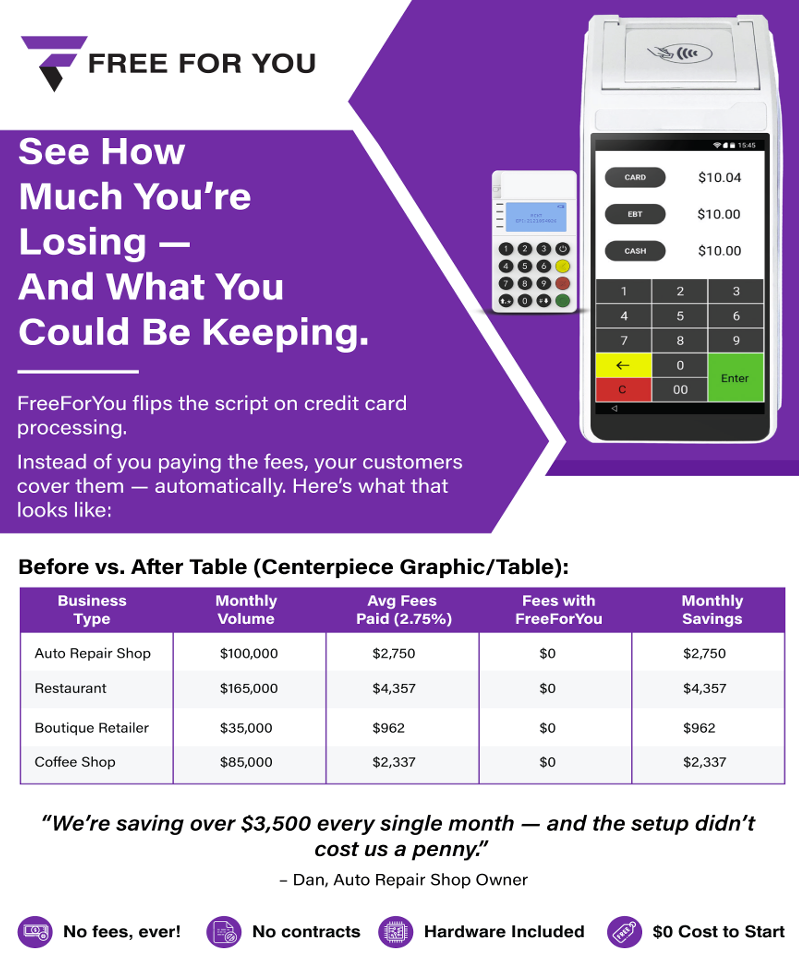

To save money on your credit card processing, check out Free For You:

Claim Your Part of the

$5.54 Billion

Visa/Mastercard Settlement

Did your U.S. business accept Visa/Mastercard credit or debit cards anytime between

January 1, 2004, and January 25, 2019?